From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on loan and deposit developments in July 2023

The seasonal upsurge in total domestic[1]deposits in July had no significant impact on the decelerating trend in their growth rate started at the beginning of the year, following the introduction of the euro. On the other side, total loans continued their strong growth, primarily in the segments of housing and consumer lending to households, while corporate lending remained subdued, as in June.

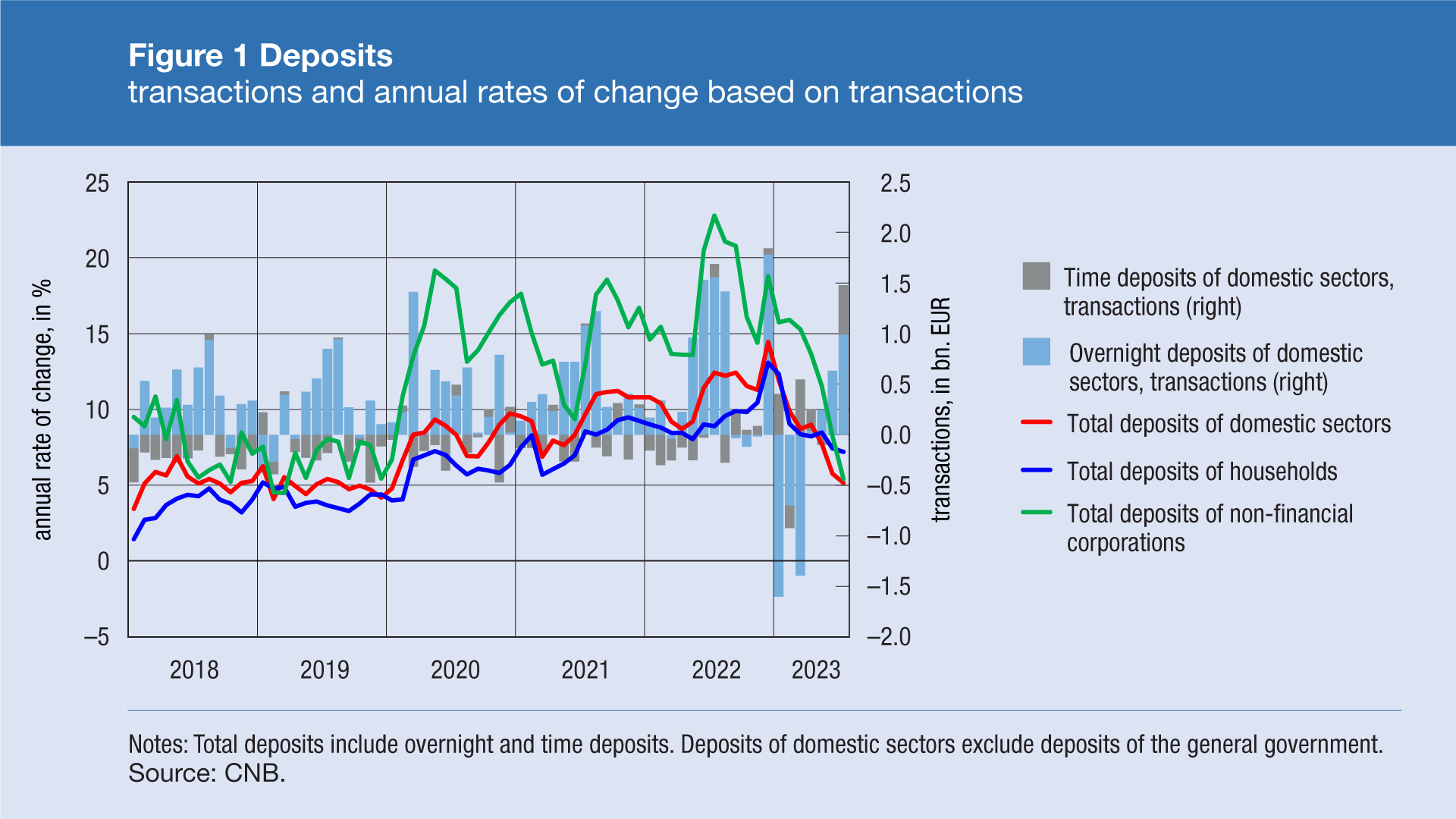

As expected, good financial results of the main part of the tourist season spurred strong growth in total domestic deposits in July, primarily of households and corporates. However, on an annual basis their growth decelerated, which can predominantly be associated with specific factors that caused deposits to increase in the second half of last year. Total deposits thus increased by EUR 1.5bn in July (or 2.8% based on transactions). Overnight deposits grew by EUR 1.0bn, and time deposits by EUR 0.5bn. Broken down by sector, household overnight deposits grew the most (EUR 0.5bn), followed by those of non-financial corporations (EUR 0.4bn), while overnight deposits of other financial institutions grew the least (EUR 0.1bn). Non-financial corporate sector (EUR 0.3 bn) and to a smaller extent other financial institutions (EUR 0.1bn) contributed the most to the increase in time deposits, while household time deposits increased only slightly. However, the growth of total domestic deposits decreased on an annual basis (from 5.8% in June to 5.2% in July, based on transactions), due to the base effect, i.e. a slightly more pronounced growth in the same month of the previous year. Namely, in the middle of last year we saw corporate borrowing going up following the growth in the prices of raw materials and energy, as well an increase in the inflow of cash to banks on the eve of the euro introduction. Broken down by sector, deposits of non-financial corporations and households slowed down their growth on an annual basis from 8.2% in June to 5.4% in July, i.e. from 7.4% in June to 7.2% in July (Figure 1).

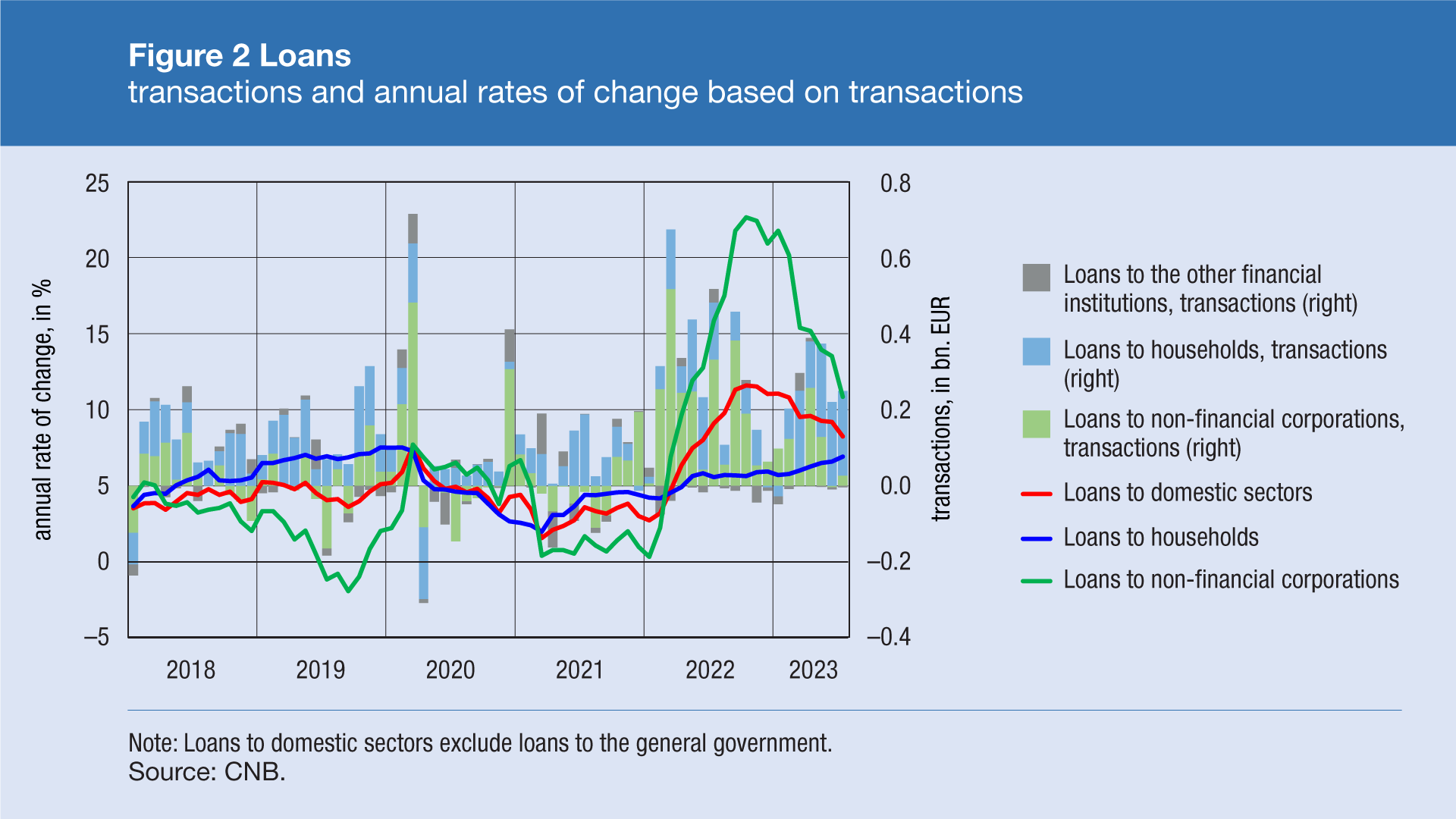

Total loans continued to grow in July (by EUR 246m or 0.7%) at a relatively strong intensity, same as over the previous months. Housing loans recorded the strongest growth in the past year (EUR 158m), reflecting a new round of state subsidies for housing loans, with general-purpose cash loans rising strongly as well (EUR 67m). In the segment of loans to non-financial corporations, investment loans[2] went up and to a smaller extent so did loans for working capital. However, loans to the tourist sector, factoring loans and shares in syndicated loans decreased, thus subduing the overall increase in corporate loans (EUR 27m). On an annual level, the growth of loans to households continued accelerating, from 6.6% in June to 6.9% in July (based on transactions), with the growth of general-purpose cash loans and housing loans continuing to accelerate, from 6.3% to 6.8% and from 9.2% to 9.5% respectively. Corporate loans slowed down their growth in July (from 13.5% to 10.8%), leading to the deceleration in the growth of total loans from 9.2% to 8.2% (Figure 2).

For detailed information on monetary statistics as at July 2023, see:

Central bank (CNB)

Other monetary financial institutions

-

Domestic sectors in the Comments exclude the general government. ↑

-

Investment loans are loans granted for medium- and long-term financing of investment projects or programmes to build, modernise or expand production facilities, invest in business premises, warehouse facilities, construction plots, vehicle and vessel fleets used in production or performance of activities and invest in other fixed assets. They include all investment loans which cannot be classified as construction loans, loans to agriculture or loans to tourism. ↑