From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on monetary developments for December 2022

The growth in total liquid assets (M4) remained moderate in 2022. The increase in money (M1) slowed down, reflecting the sharp decrease in currency outside credit institutions ahead of Croatia’s accession to the euro area. Funds in transaction accounts rose sharply in the same period, while the acceleration in quasi-money growth was mainly attributable to foreign currency deposits.

The increase in total placements of monetary institutions to domestic sectors (except the central government) more than doubled in 2022 compared to the end of 2021, primarily due to a much faster increase in loans to non-financial corporations.

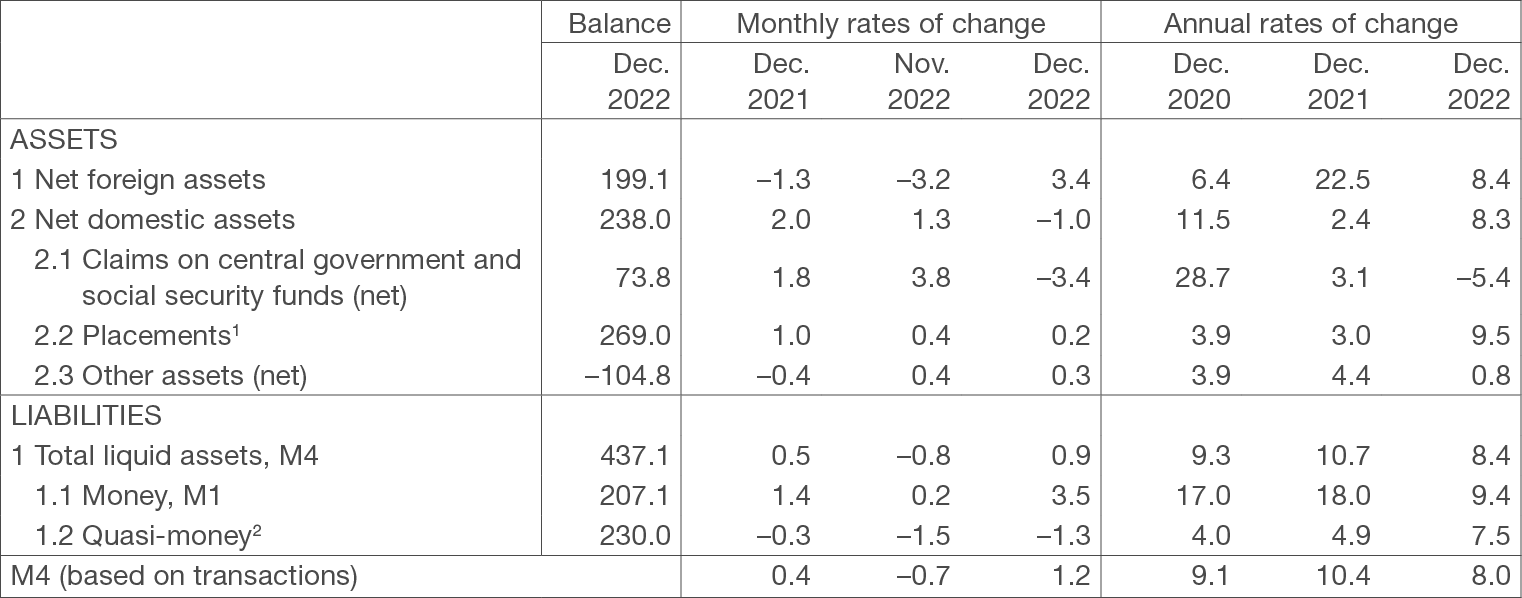

Total liquid assets (M4[1]) rose by HRK 5.1bn (1.2%, transaction-based) in December, reflecting the growth in net foreign assets (NFA) of the monetary system (HRK 7.9bn), while net domestic assets (NDA) decreased by HRK 2.8bn (Table 1). Looking at the NFA structure, the NFA of the CNB surged (HRK 24.0bn), mostly due to the sharp increase in domestic banks’ deposits in the TARGET2 system (HRK 13.0bn) and, to a lesser extent, the purchase of foreign exchange from the government. In December, the CNB in two instances purchased a total of EUR 500m from the Ministry of Finance, which increased central government deposits with the CNB, leading to the fall in NDA.

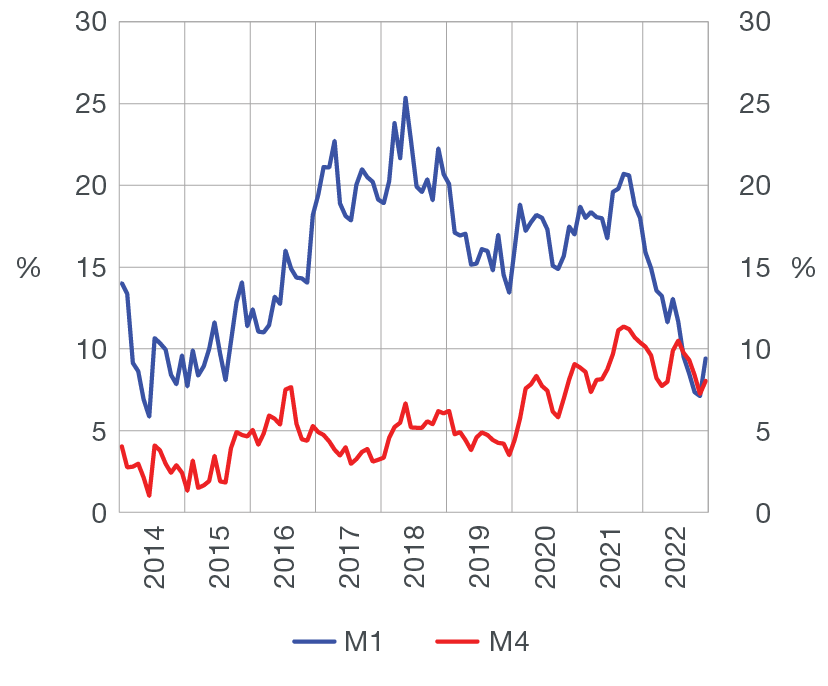

In 2022 as a whole, the growth in total liquid assets remained moderate (8.0% in December 2022, transaction-based, Figure 1), while the increase in money (M1[2]) almost halved from the previous year (from 18.0% in 2021 to 9.4% in 2022, transaction-based). Within M1, currency outside credit institutions recorded a sharp decline ahead of Croatia’s accession to the euro area (of HRK 21.5bn or 59.4% from the end of 2021). The amount of currency in circulation decreased at a similar pace in peer countries in the year before the euro introduction, with the fall being particularly marked in the last months before the euro cash changeover. The growth in quasi-money picked up from 4.4% in late 2021 to 6.8% in late 2022 (transaction-based, Table 3), with a notable rise in the contribution of foreign currency deposits to total deposit growth, which may be attributed to the recovery of tourism and the process of euro area accession. Some of the growth of deposits in banks was the outcome of the channelling of currency from circulation into banks in the context of the euro cash changeover so as to ensure automatic conversion of kuna funds into euro.

| Figure 1 Monetary aggregates annual rates of change based on transactions |

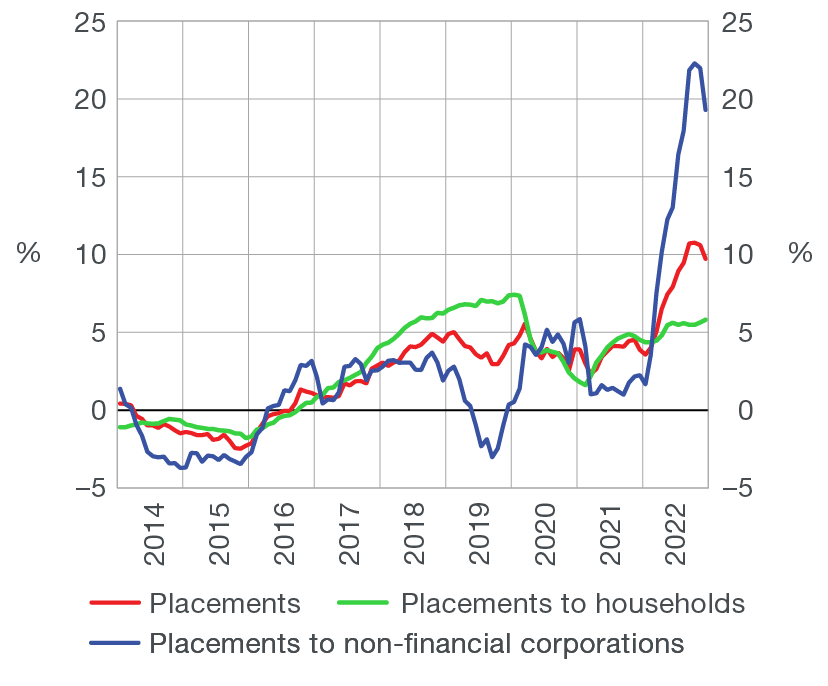

Figure 2 Placements annual rates of change based on transactions |

|

|

| Source: CNB. |

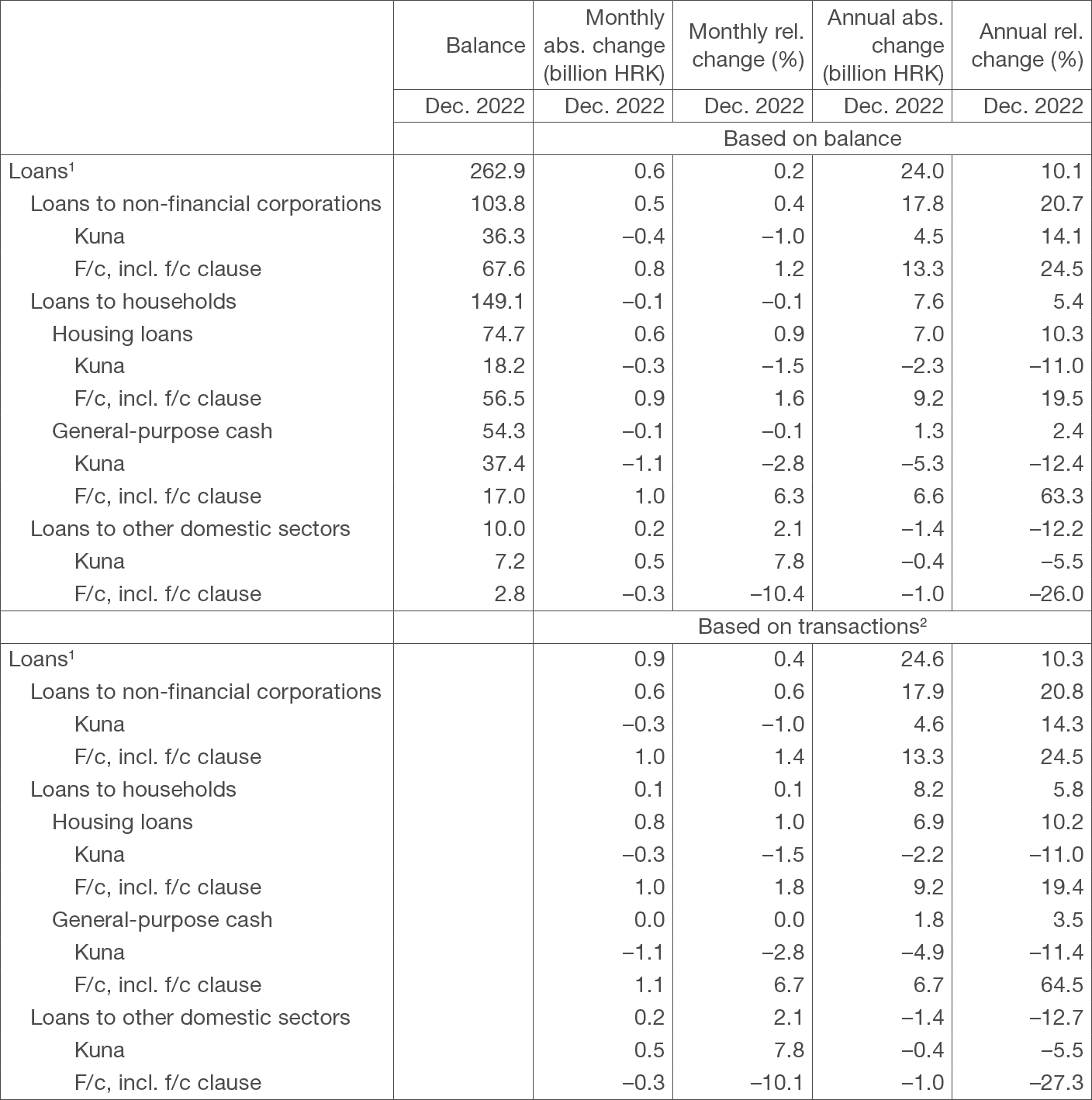

Total placements of monetary institutions to domestic sectors (excluding the central government) increased by HRK 0.9bn in December (0.3% based on transactions), standing at HRK 269.0bn at the end of 2022. The overall monthly increase in total placements was due to the rise in loans, which account for their largest share. Broken down by sectors, loans to non-financial corporations grew the most (HRK 0.6bn), followed by loans to the local government and households (HRK 0.2bn and HRK 0.1bn, respectively). In the structure of loans to the household sector, housing loans grew strongly in December (HRK 0.8bn), mainly due to more buoyant demand of households for housing loans amid the expected tightening of lending standards. An opposite effect was produced by the sharper than usual decrease in the use of overdraft facilities in December (HRK 0.6bn), whereas general-purpose cash loans remained almost unchanged.

The growth in total placements reached its ten-year high in 2022, standing at 9.7% on an annual level in December 2022 (transaction-based, Figure 2). The largest contribution to the growth in placements came from non-financial corporate loans, which in some months recorded annual growth rates of more than 20.0%, mostly due to loans to corporates operating in the energy sector. The increase in loans to households also gained momentum on an annual level (up from 4.5% in December 2021 to 5.8% in December 2022) owing to the faster increase in housing loans (from 9.2% to 10.2%) and general-purpose cash loans (from 2.4% to 3.5%).

Table 1 Summary consolidated balance sheet of monetary institutions

in billion HRK and %

1 The sum total of asset items 2.2 to 2.8 of Bulletin Table B1: Consolidated balance sheet of monetary financial institutions.

2 The sum total of liability items 2 to 5 of Bulletin Table B1: Consolidated balance sheet of monetary financial institutions.

Source: CNB.

Table 2 Loans (except the central government) and main components

in billion HRK and %

1 In addition to loans to households and corporates, they also include loans to the local government and other financial institutions.

2 The transactions show changes that exclude the effects of exchange rate changes, securities price adjustments, reclassification and write-off of loans, including the sale of loans in the amount of their value adjustment.

Source: CNB.

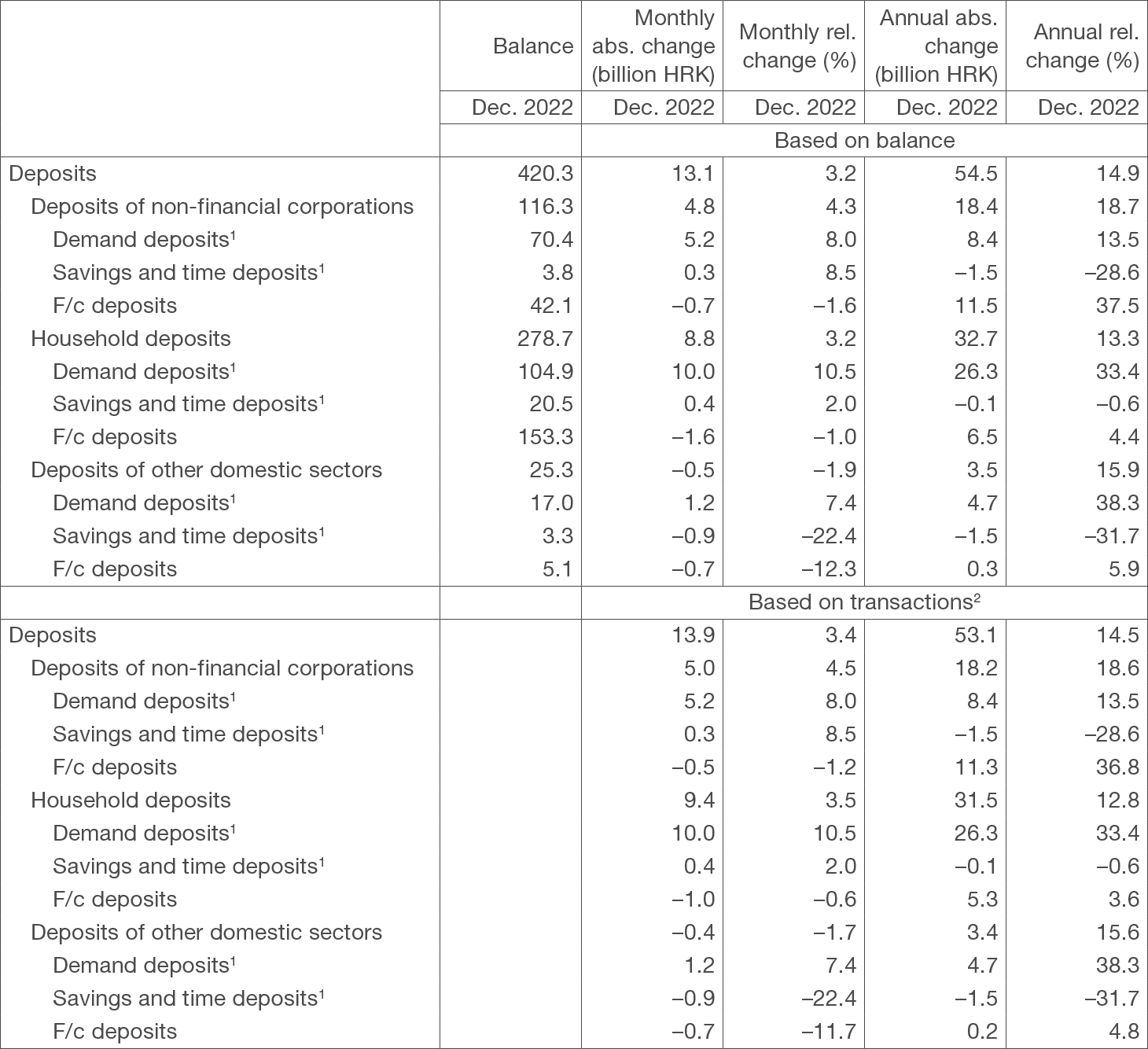

Table 3 Deposits (except the central government) and main components

in billion HRK and %

1 Includes only kuna sources of funds of credit institutions.

2 The transactions show changes that exclude the effects of exchange rate changes, securities price adjustments, reclassification and write-off of loans, including the sale of loans in the amount of their value adjustment.

Source: CNB.

For detailed information on monetary statistics as at December 2022, see:

Central bank (CNB)

Other monetary financial institutions