From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on loan and deposit developments in March 2023

Total deposits of domestic sectors[1] continued to decrease for the third consecutive month. The decrease in deposits was mostly attributable to the refinancing of external public debt by domestic public debt. In the structure of corporate deposits the decline in overnight deposits and the increase in time deposits continued, while both deposit categories declined in households and non-financial institutions. At the same time, lending to domestic sectors rose. The sharpest increase was seen in loans to households, and corporate loans and loans to other domestic sectors also grew moderately.

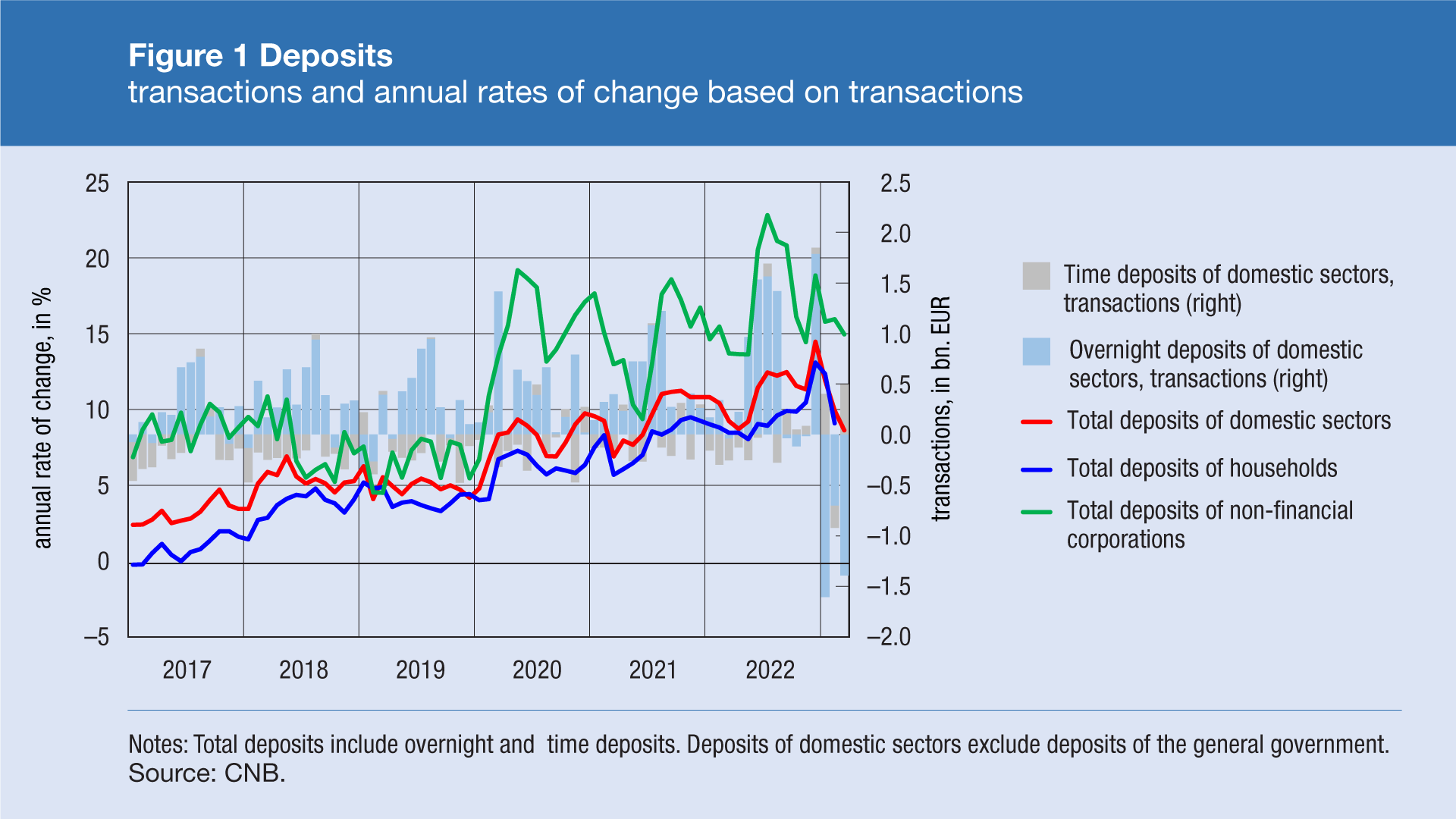

Total deposits of domestic sectors have been decreasing for the third consecutive month and in March they decreased by EUR 0.9bn or 1.7% (transaction-based) from the month before. The decrease in deposits was mostly attributable to the refinancing of external public debt by domestic debt. As a result, bank assets also declined in March, i.e. deposits with the CNB decreased by EUR 2.0bn. At the same time, the overall position of Croatia in TARGET2 declined by EUR 2.3bn, primarily mirroring the decline in the component of credit institutions in that position. Overnight deposits[2] fell by EUR 1.4bn and time deposits increased by EUR 0.5bn in March. Broken down by sectors, non-financial corporations decreased overnight deposits by EUR 0.8bn and increased time deposits by EUR 0.7bn. Corporations thus continued to transfer funds from overnight to time deposits due to the rise in interest rates on time deposits. At the same time, households and other non-banking financial institutions reduced overnight deposits in the equal amounts of EUR 0.3bn, however, these sectors also recorded a decrease in time deposits in March. This was also driven by the subscription of government bonds in early March.[3] Observed on an annual level, the growth in total corporate deposits slowed down from 15.9% in February to 14.9% in March (transaction-based) and household deposits decelerated from 9.1% to 8.4% (Figure 1).

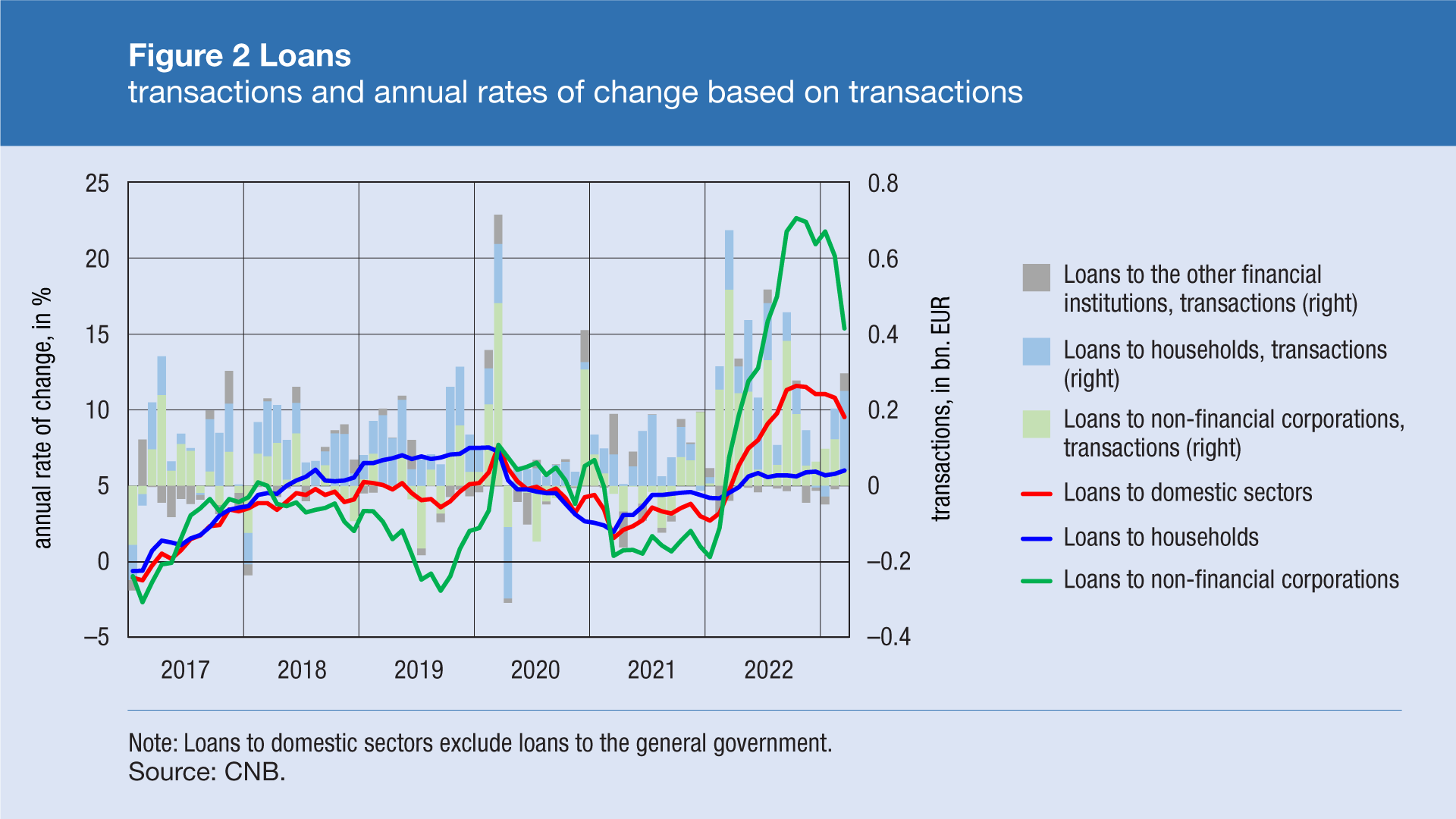

Loans to domestic sectors grew by EUR 0.3bn or 0.9% (transaction-based) in March, predominately reflecting the rise in lending to households (EUR 0.2bn or 1.1%). Half of the growth in loans to households came from general-purpose cash loans and housing loans also picked up moderately. A stronger growth in housing loans can be expected in the upcoming months following a new round of the housing loans subsidy programme in which receipt of applications for subsidies started in the beginning of the second decade of March. Loans to non-financial corporations and other non-banking financial institutions also grew moderately. In the sector of non-financial corporations investment loans increased, and working capital loans declined. On an annual level, the growth in loans to non-financial corporations decelerated from 20.1% in February to 15.4% in March (Figure 2) due to the base effect, i.e. on account of a much stronger growth in corporate loans in March last year. The annual growth in household loans accelerated moderately (from 5.8% to 6.0%), reflecting a rise in general-purpose cash loans (from 3.5% to 4.3%), while housing loans decelerated (from 9.8% to 9.6%).

For detailed information on monetary statistics as at March 2023, see:

Central bank (CNB)

Other monetary financial institutions

-

Domestic sectors in the Comments exclude the general government. ↑

-

Overnight deposits are deposits which clients place at a bank overnight. The most common categories of such deposits are funds in current accounts or giro accounts (transaction accounts). ↑

-

In the first round of subscription, from 22 February to 1 March, which was intended for citizens, the allocated amount of the subscription of government bonds was EUR 1.3bn. It is estimated that citizens subscribed bonds in the amount of about EUR 1bn until the end of February, and the remaining amount in the beginning of March. In the second round of subscription held on 3 March, which was intended for institutional investors, interest in the subscription of government bonds was about EUR 1bn, however, EUR 0.5bn was allocated. ↑