From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on monetary developments for March 2022

Total liquid assets (M4) decreased in March reflecting the fall in the net foreign assets of the monetary system. Money (M1) decreased as well, and so did quasi-money, primarily due to the fall in foreign currency deposits. The slowdown in the growth of monetary aggregates M4 and M1 continued on an annual level.

Total placements of monetary institutions to domestic sectors (except the central government) increased considerably in March, primarily due to the growth in placements to non-financial corporations and, to a lesser degree, to the growth in placements to households. Consequently, the growth of corporate placements accelerated substantially on an annual level.

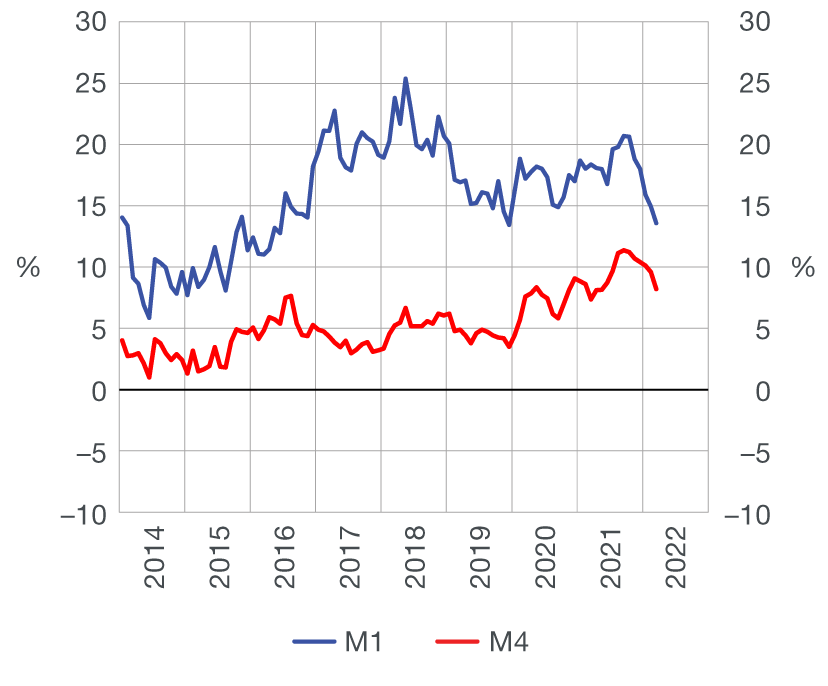

Total liquid assets (M4[1]) decreased in March, to HRK 2.7bn or 0.7% (based on transactions, Table 1) as a result of the strong fall in net foreign assets (NFA) of the monetary system and the parallel growth in net domestic assets (NDA). The growth of NDA was a reflection of the growth of placements to domestic sectors and the growth in net claims on the central government, which was primarily registered thanks to the decrease in government deposits with the CNB. Money (M1[2]) decreased by HRK 0.6bn (0.3%) on a monthly level, firstly due to the decrease in deposit money of non-financial corporations. Quasi-money registered a more prominent fall on a monthly level in March (HRK 2.1bn or 1.0%), largely due to the reduction in foreign currency household deposits and to a lesser degree of foreign currency deposits of other domestic sectors (Table 3). Monetary developments in March were impacted by the Russian military aggression against Ukraine, resulting in a fall in NFA of the monetary system in the first half of the month due to withdrawals of household deposits. Accordingly, the annual growth of M4 continued to slow down, from 9.6% to 8.2%, and of M1, from 14.9% to 13.6% (Figure 1).

| Figure 1 Monetary aggregates annual rates of change based on transactions |

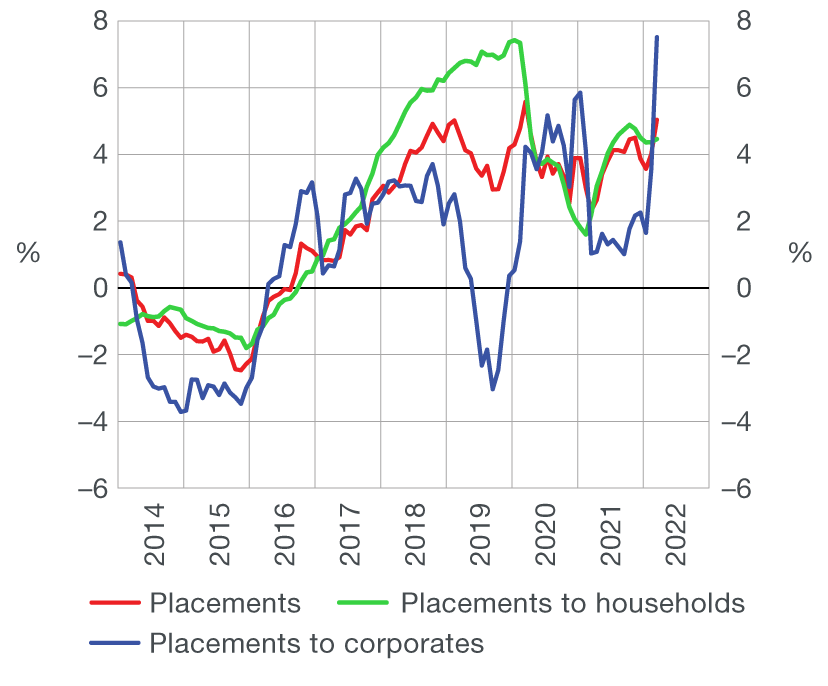

Figure 2 Placements annual rates of change based on transactions |

|

|

| Source: CNB. |

Total placements of monetary institutions to domestic sectors (except the central government) grew strongly in March, by HRK 4.0bn (1.6%, based on transactions), their annual rate of growth accelerating from 4.0% to 5.0% (Figure 2). The growth in placements was a result of the growth in loans as the main component of placements. Corporate loans thus increased the most in March (HRK 3.7bn), loans to households increased by a lesser degree (HRK 0.9bn), while loans to other domestic sectors fell (HRK 0.4bn) (Table 2). In the structure of loans to households, the growth of housing loans (HRK 0.3bn) and general-purpose cash loans (HRK 0.3bn) continued. The annual rates of growth for both housing and general-purpose loans remained at previous month’s level (8.0% and 3.4%, respectively) so loans to households accelerated only slightly from 4.4% in February to 4.5% in March. Corporate loans, on the other side, accelerated their annual growth considerably (from 2.4% to 6.7%).

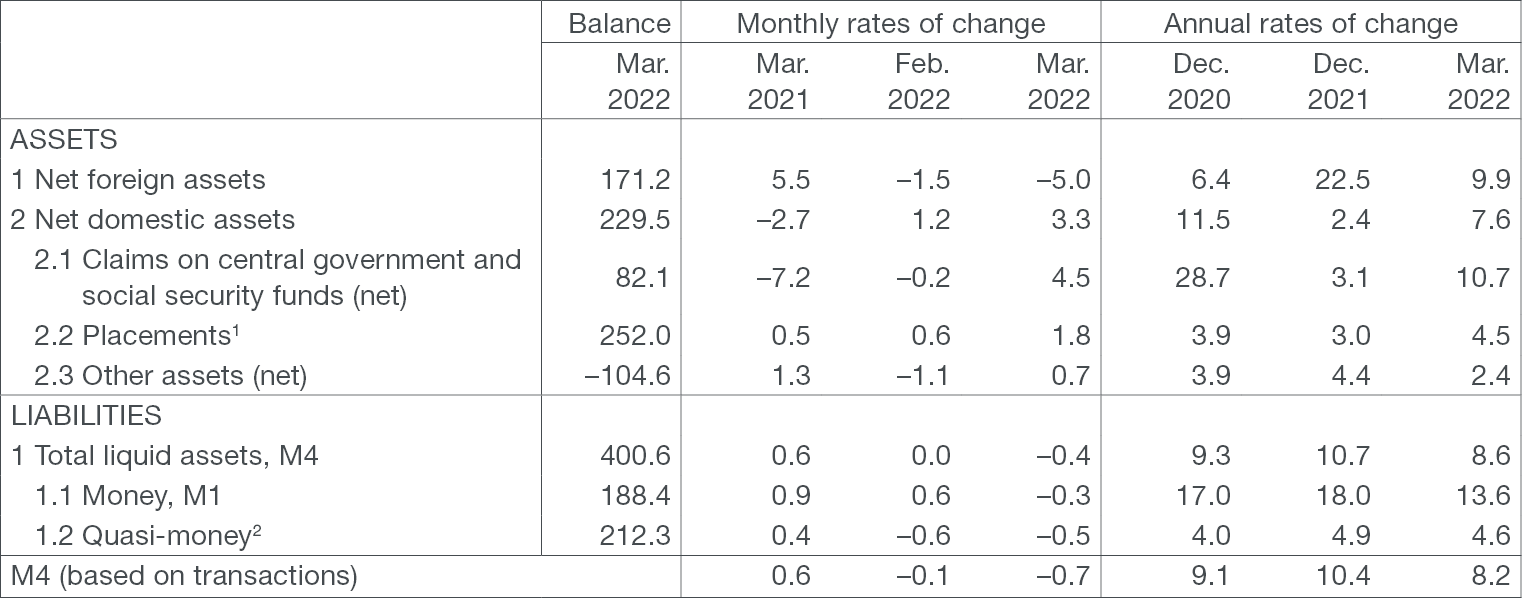

Table 1 Summary consolidated balance sheet of monetary institutions

in billion HRK and %

1The sum total of asset items 2.2 to 2.8 of Bulletin Table B1: Consolidated balance sheet of monetary financial institutions.

2The sum total of liability items 2 to 5 of Bulletin Table B1: Consolidated balance sheet of monetary financial institutions.

Source: CNB

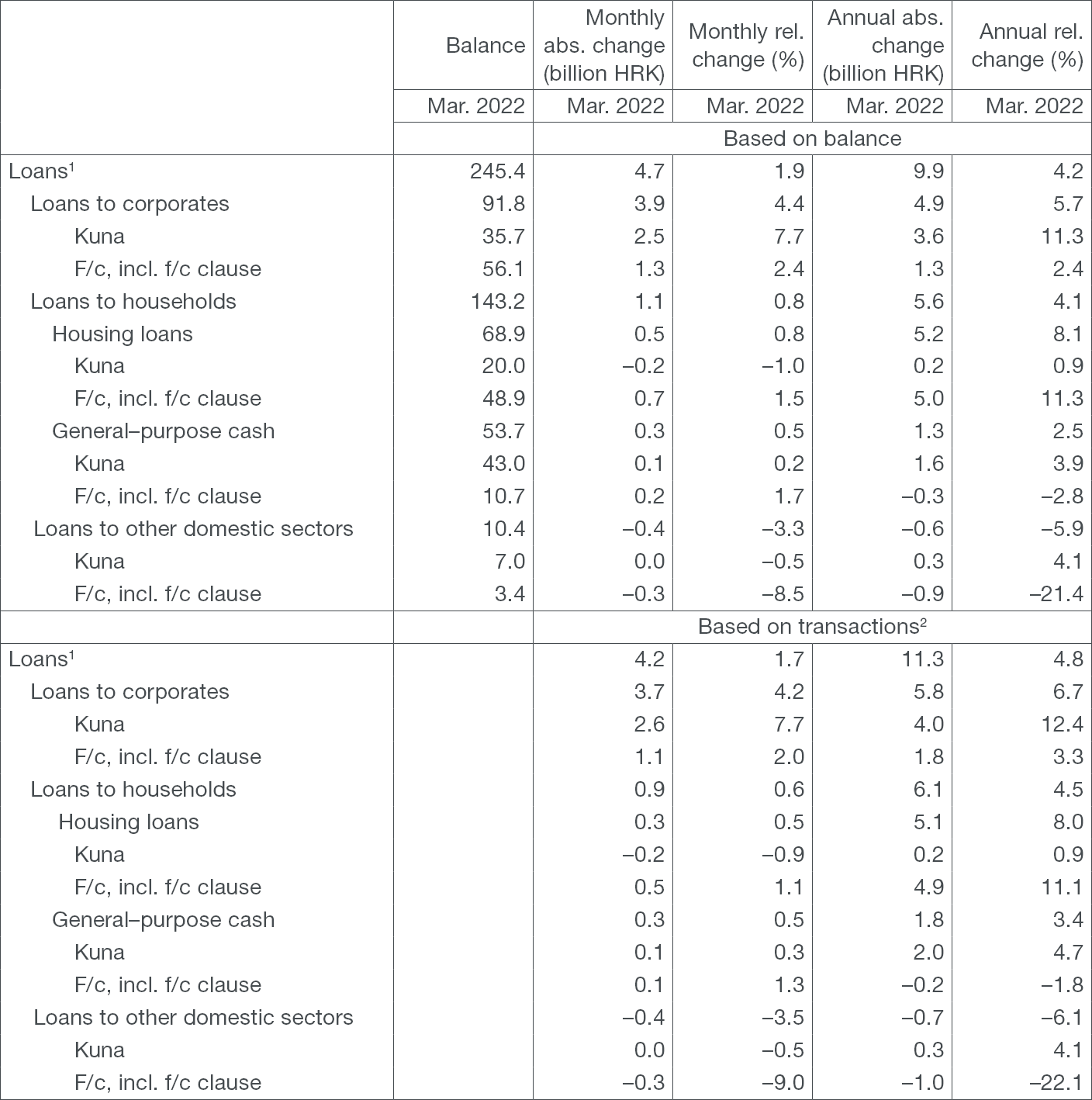

Table 2 Loans (except the central government) and main components

in billion HRK and %

1In addition to loans to households and corporates, they also include loans to the local government and other financial institutions.

2The transactions show changes that exclude the effects of exchange rate changes, securities price adjustments, reclassification and write-off of placements, including the sale of loans in the amount of their value adjustment.

Source: CNB

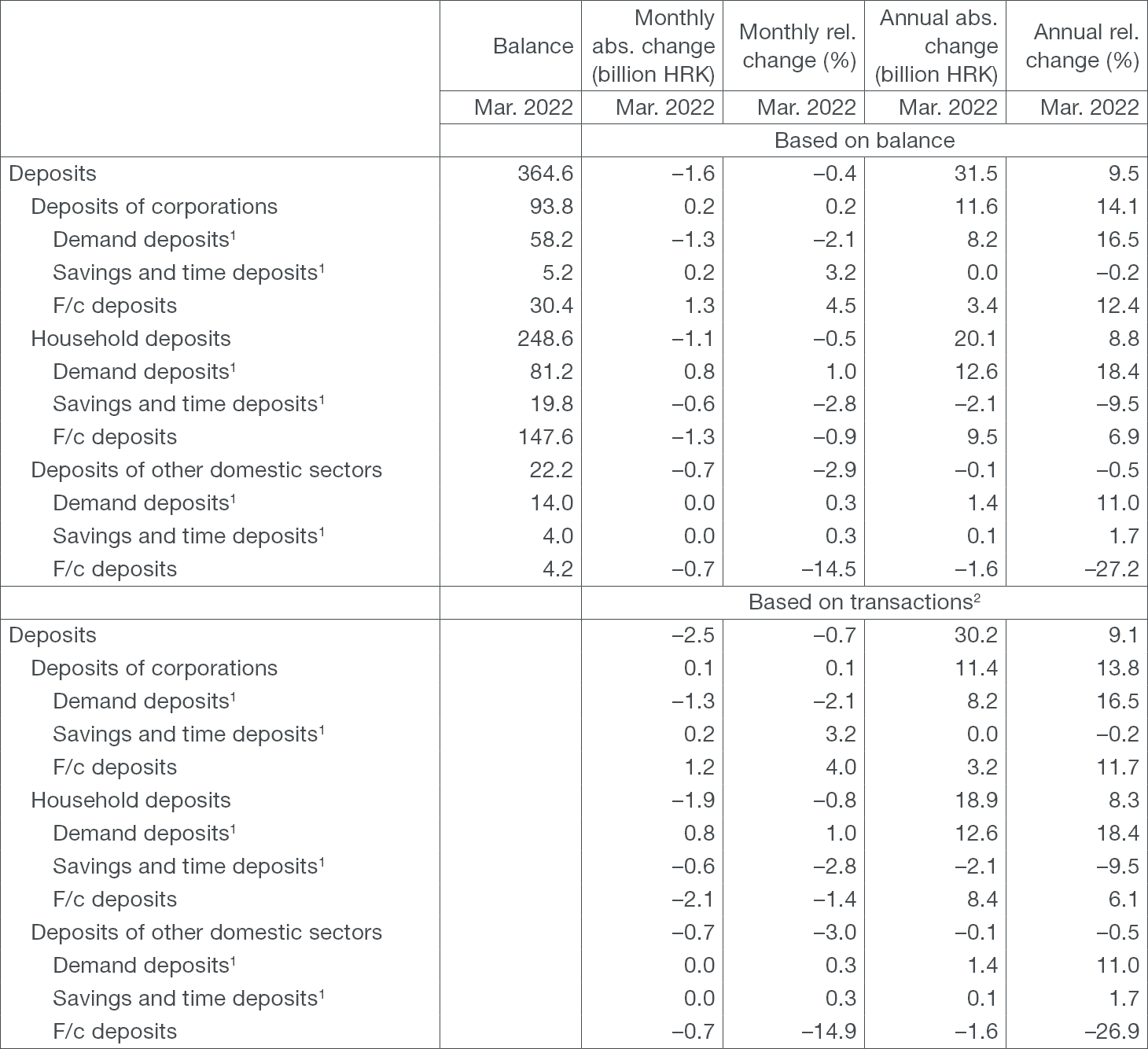

Table 3 Deposits (except the central government) and main components

in billion HRK and %

1Includes only kuna sources of funds of credit institutions.

2The transactions show changes that exclude the effects of exchange rate changes, securities price adjustments, reclassification and write-off of placements, including the sale of loans in the amount of their value adjustment.

Source: CNB

For detailed information on monetary statistics as at March 2022, see:

Central bank (CNB)

Other monetary financial institutions