From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on the balance of payments, gross external debt and the international investment position in 4Q 2022

The balance in the current and capital account of the balance of payments deteriorated noticeably in the fourth quarter of 2022, mainly due to the widening of the foreign trade deficit, which, coupled with unfavourable developments in the first half of the year, resulted in a considerable fall in total current and capital account surplus in 2022 from 2021.

In accordance with developments in the current account, the financial account of the balance of payments saw a considerable net capital inflow and the resulting worsening of absolute indicators of external debt and international investment position, however, fast growth of the nominal GDP alleviated the intensity of deterioration in the relevant indicators of debt.

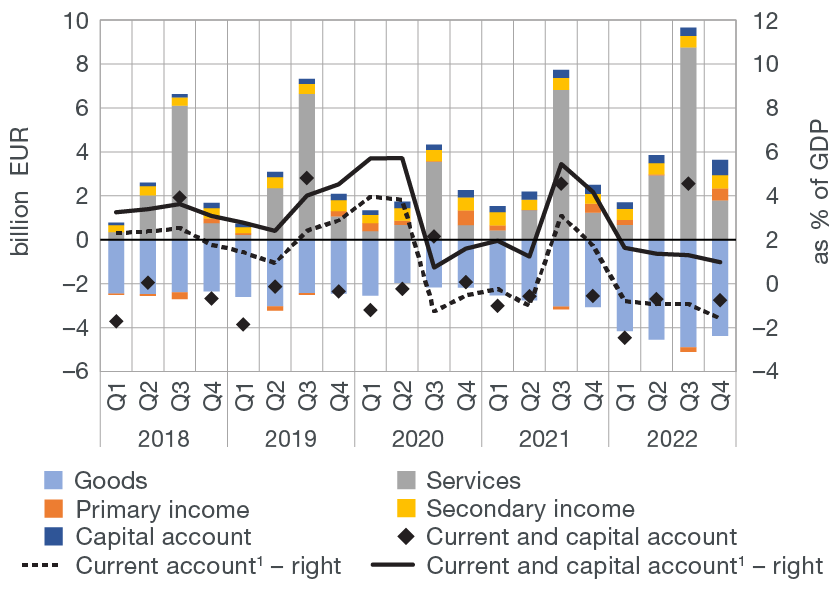

The current and capital account of the balance of payments ran a deficit of EUR 0.7bn in the fourth quarter of 2022, up EUR 0.2bn from the same period of the year before (Figure 1a). This is exclusively the result of a sharp increase in foreign trade deficit, mostly attributable to the growth in net imports of energy, while all other sub-accounts witnessed more favourable developments than in the same period of the year before, partly mitigating the widening of the foreign trade deficit. In the last three months of 2022, net services exports rose considerably, mainly owing to rising tourism revenues, while the considerable increase in total surplus in the secondary income and capital transactions accounts was due to record high disbursements from EU funds to end users. Albeit to a lesser extent, the increase in the surplus in the primary income account also made a positive contribution to developments in the current and capital account. As a result of such developments and the unfavourable outturn in the first half of the year, in 2022, the surplus in the current and capital account fell noticeably and stood at 1.0% of GDP, down from 4.2% of GDP in 2021.

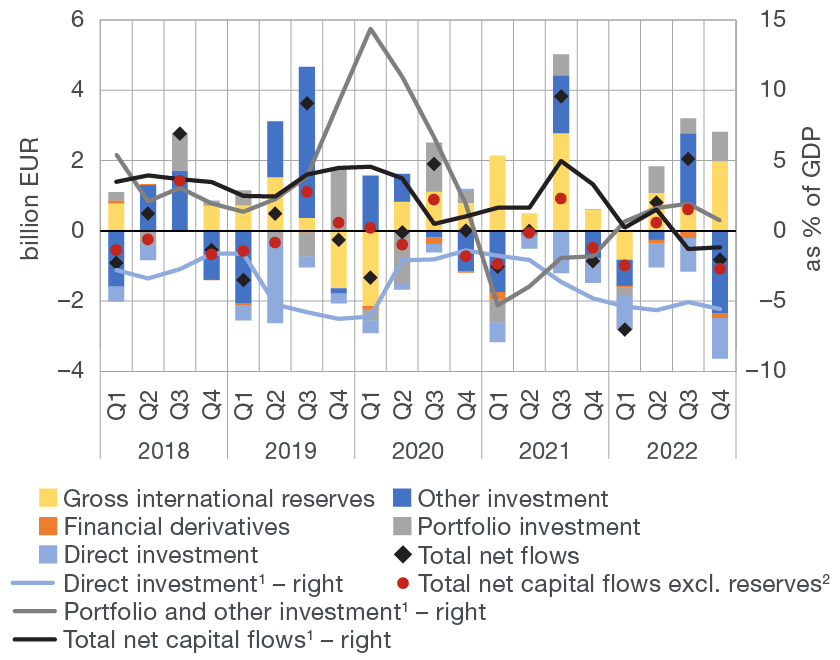

Figure 1 Balance of payments

| a) Current and capital account | b) Financial account |

|

|

1 Sum of the last four quarters.

2 Excluding the change in gross international reserves and foreign liabilities of the CNB.

Note: In the figure showing the financial account, the positive value denotes net capital outflow abroad and the negative value denotes net capital inflow.

Source: CNB.

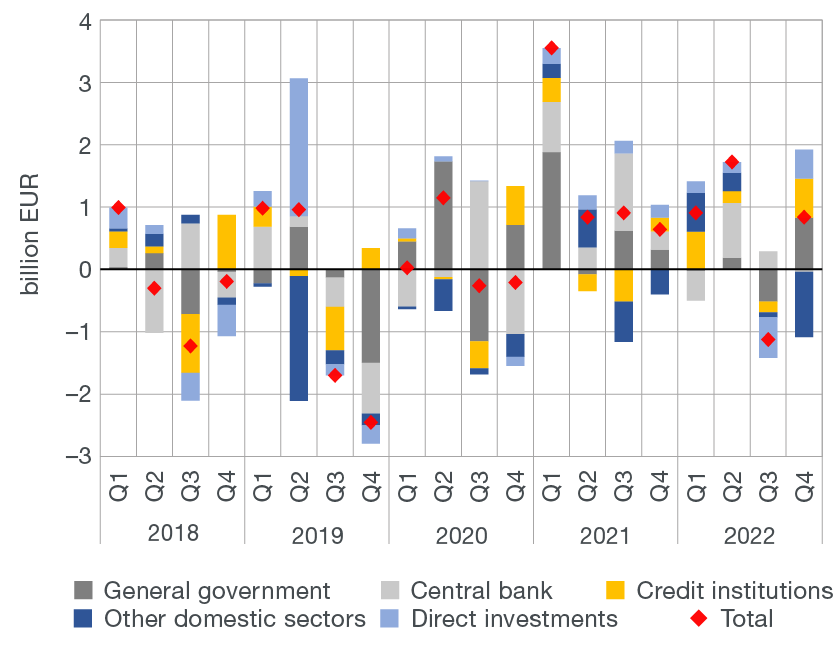

The financial account of the balance of payments saw a net capital inflow of EUR 0.8bn in the fourth quarter of 2022, almost equal to the net inflow recorded in the same period of the year before (Figure 1b). However, the structure of the net inflow by sub-accounts was much different from that seen in the previous year. Thus the net inflow in the account of other investment was much bigger due to a more pronounced seasonal decline in foreign assets of banks following the end of the tourist season than in 2021 and due to a much bigger government borrowing abroad. The account of direct investment also recorded a larger net inflow due to a considerable fall in external debt claims of enterprises owned by residents. In contrast, after being neutral in the year before, the account of portfolio investment this year saw a net ouflow of capital due to a fall in non-resident investment in domestic securities and growth in these investments by residents abroad. Also, stronger net inflows of capital in the other investment and direct investment accounts were fully compensated by a much faster growth in international reserves than in the same period of the year before, given that the central bank purchased foreign exchange from the government on several occasions, particularly after the disbursement from the European Commission of the second tranche in the framework of the National Recovery and Resilience Plan.

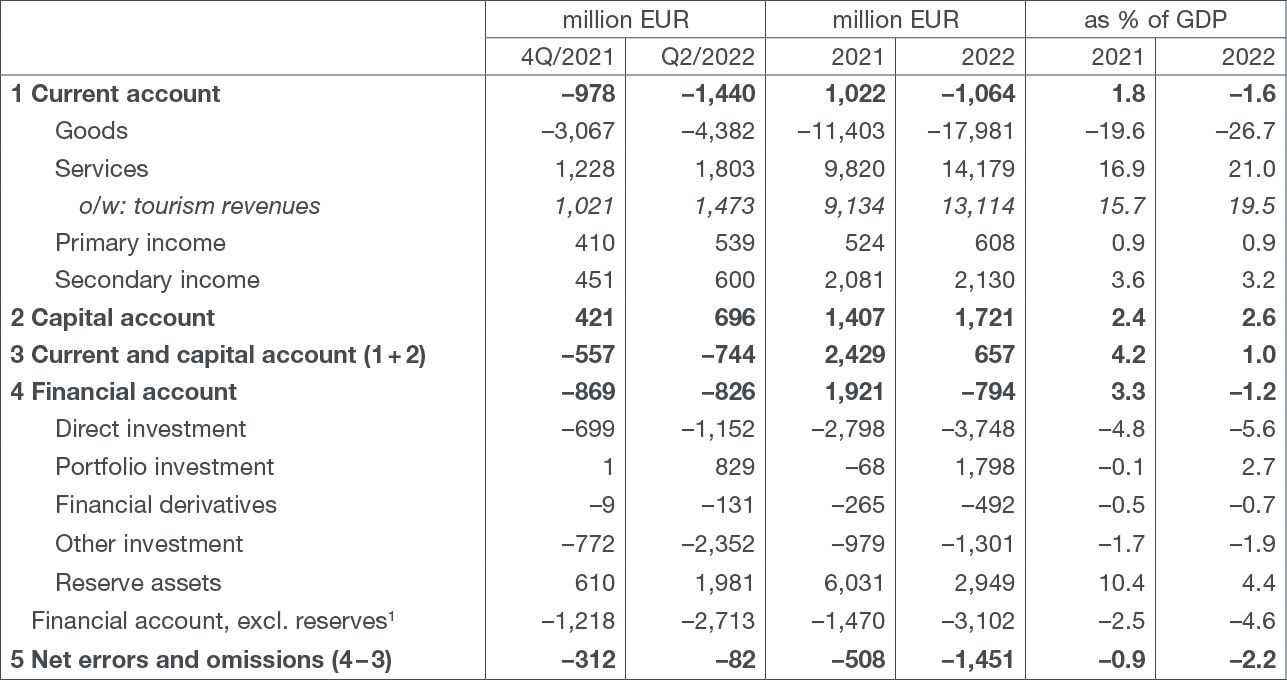

Table 1 Balance of payments

1 Excluding the change in gross international reserves and foreign liabilities of the CNB. The investment of a portion of international reserves in reverse repo agreements results in a simultaneous change in CNB assets (recorded in the reserve assets account) and liabilities (recorded in the other investment account) and thus has a neutral impact both on changes in the central bank’s net foreign position and the overall financial account balance.

Note: The positive value of financial transactions denotes net capital outflow abroad and the negative value denotes net capital inflow.

Source: CNB.

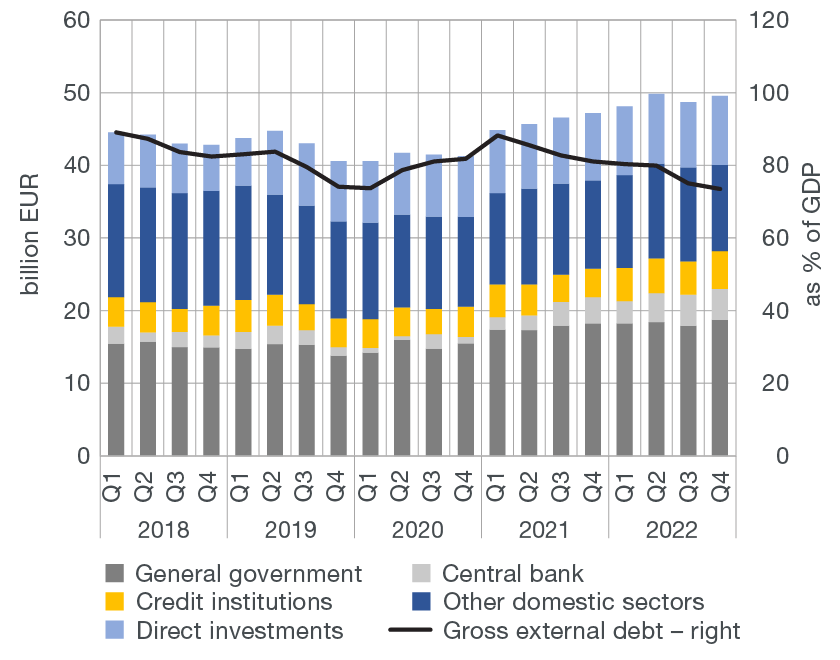

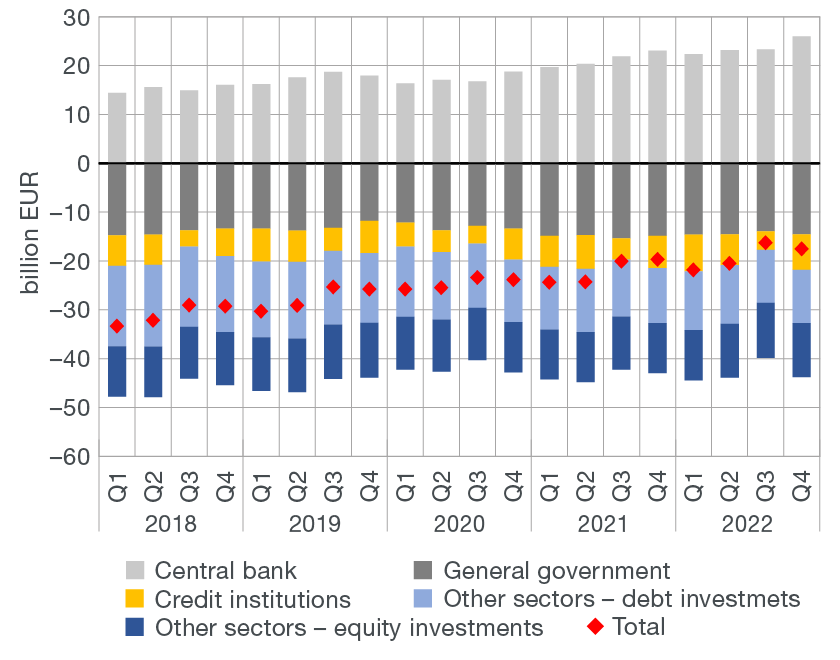

The stock of gross external debt at the end of December 2022 stood at EUR 49.6bn or 73.5% of GDP (Figure 2a), an increase of EUR 0.8bn from the end of September 2022, mostly attributable to the growth in gross external debt of the government and credit institutions (Figure 2b). However, owing to a strong nominal GDP growth, the relative indicator of foreign debt improved by 1.5 percentage points during that period.

Figure 2 Gross external debt

| a) Stock of gross external debt | b) Change in gross external debt |

|

|

Note: Changes in gross external debt are a result of net transactions of domestic sectors and exchange rate and other adjustments.

Source: CNB.

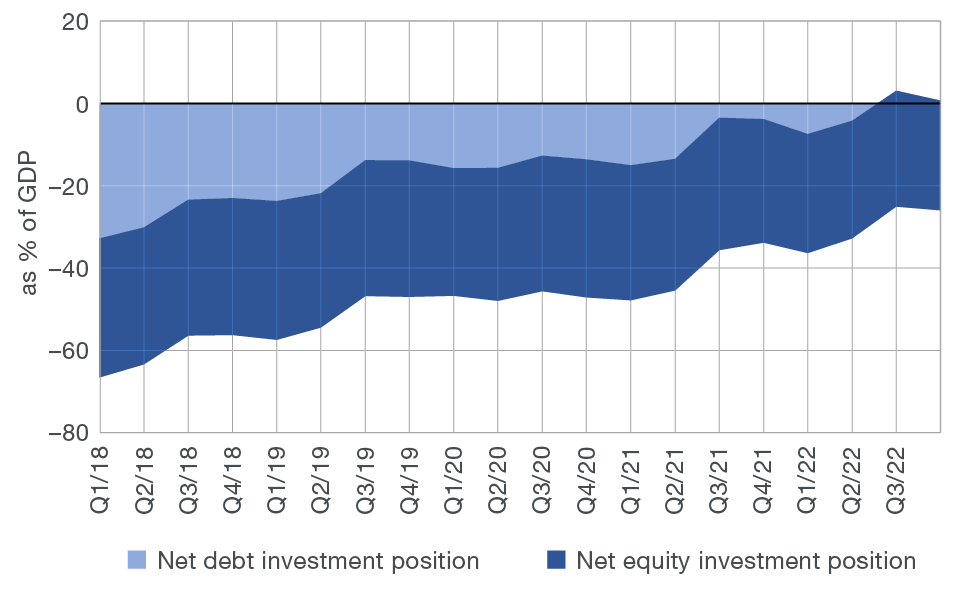

In addition to gross external debt growth, the growth in net external debt in the third quarter (EUR 0.8bn) was also influenced by a sharp fall in the foreign assets of banks, only partly mitigated by the increase in international reserves. Thus the stock of net external debt at the end of 2022 stood at EUR 0.3bn or 0.4% of GDP, up from the negative outturn of EUR –0.7bn or –1.0% of GDP at the end of September of that year. The net international investment position also worsened, having fallen from EUR –16.3bn or –25.0% of GDP at the end of September to EUR –17.5bn or –25.9% of GDP at the end of December 2022 (Figure 3a and 3b).

Figure 3 International investment position (net)

| a) Position by sector | b) Relative indicator by type of investment |

|

|

Notes: The international investment position (net) equals the difference between domestic sectors' foreign assets and liabilities at the end of a period. The negative value of the net international investment position indicates that foreign liabilities of Croatian residents are greater than their foreign assets. Included are assets and liabilities based on debt instruments, equity investments, financial derivatives, and other instruments. Figure 3b includes financial derivatives and other liabilities in the net debt investment position.

Source: CNB.

Data revision

Data on the balance of payments, gross external debt and the international investment position are revised in accordance with the commonly used practice, based on subsequently available data.

Detailed balance of payments data

Detailed gross external debt data

Detailed data on the international investment position