From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on loan and deposit developments in June 2023

The growth of total deposits of domestic sectors [1] accelerated in June due to increased inflows from abroad at the beginning of the tourist season. As regards the structure of total deposits, overnight deposits of all domestic sectors went up, while time deposits remained almost unchanged given that the increase in corporate time deposits was almost the same as the decrease in time deposits of other financial institutions and households. Credit activity continued to trend up in June at a similar pace as over the previous few months. Loans to non-financial corporations held steady, while the growth in loans to households was largely fuelled by housing loans granted under the government subsidy programme and to a lesser extent by general-purpose cash loans. Loans to corporates and other financial institutions remained unchanged.

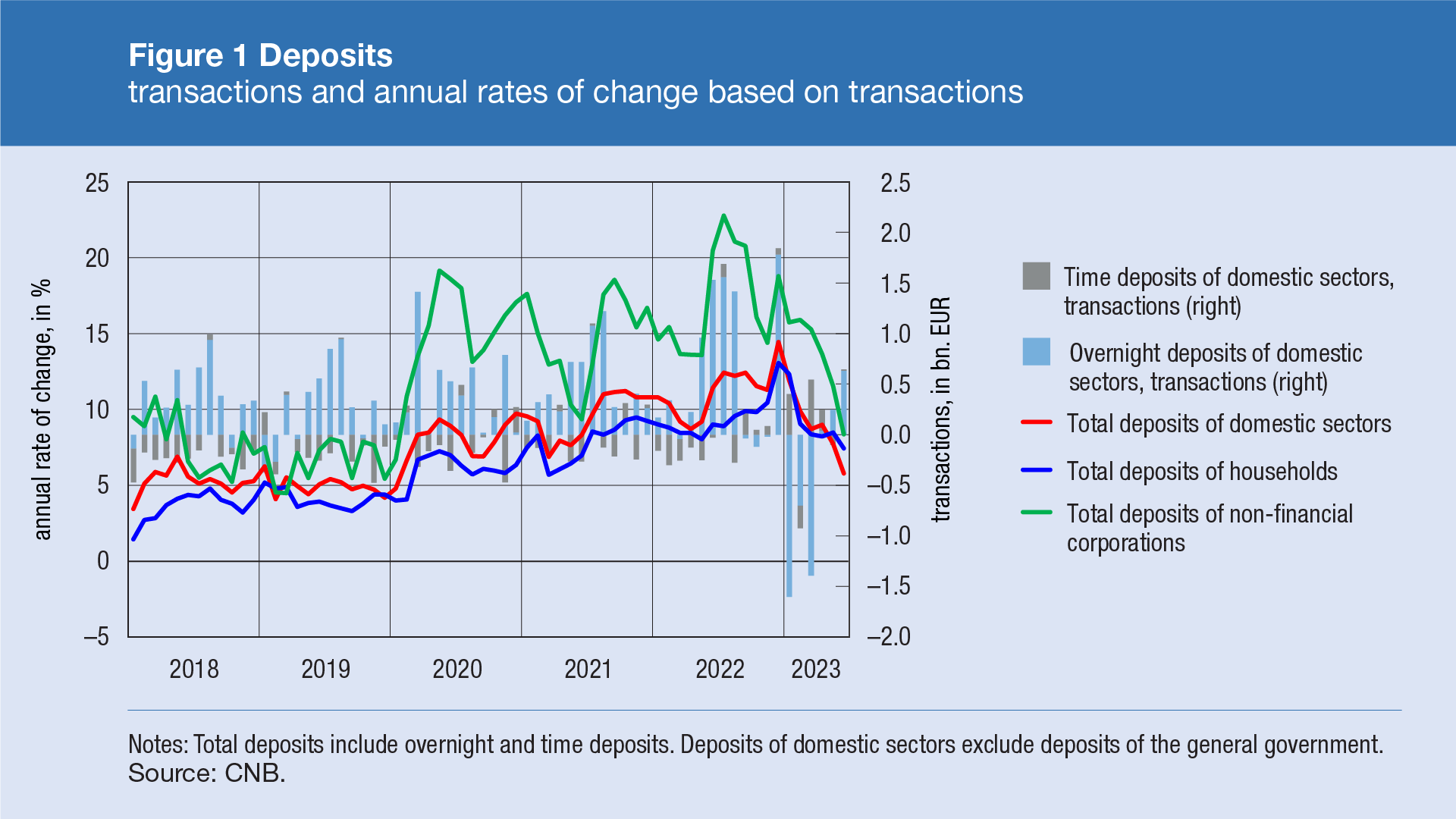

The growth in total deposits of domestic sectors picked up in June from the previous months and stood at EUR 0.6bn or 1.2% (transaction-based), driven by higher inflows from abroad at the beginning of the tourist season. In the structure of total deposits, overnight deposits rose, while time deposits remained virtually unchanged. Broken down by sector, a sharp growth in overnight deposits was recorded for non-financial corporations (EUR 0.4bn) and households (EUR 0.3bn), while overnight deposits of other financial institutions went down (EUR 0.1bn). Time deposits of non-financial corporations also increased (EUR 0.3bn), which was almost entirely offset by the decline in time deposits of other financial institutions and households by EUR 0.2bn and EUR 0.1bn respectively. On account of base effect reflecting a faster growth in June last year, the growth in total deposits of domestic sectors decelerated on an annual level, from 7.7% in May to 5.8% in June (transaction-based). The fall in deposits of other financial institutions continued to deteriorate sharply, with a slowdown in the growth of both corporate and household deposits (Figure 1).

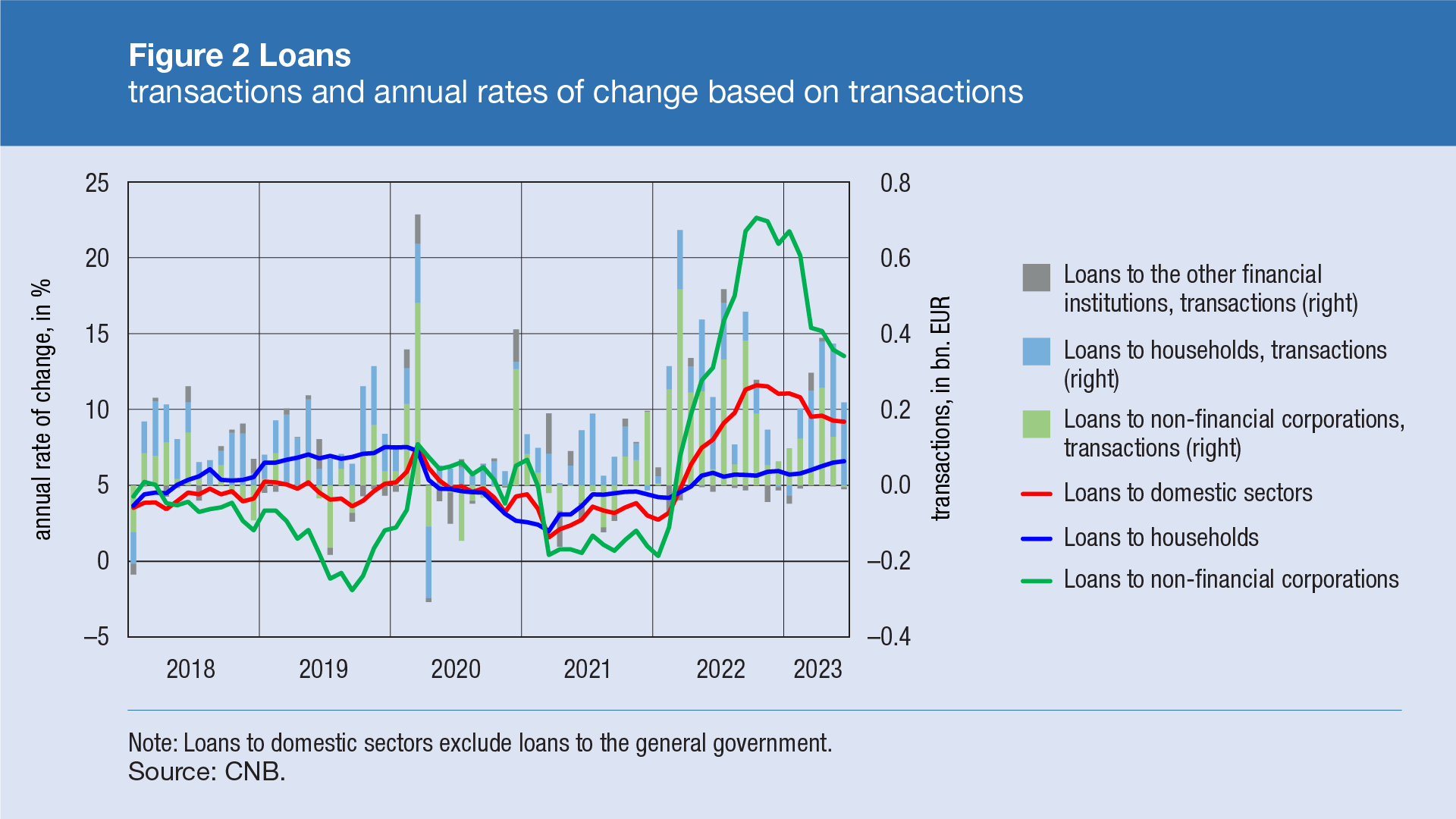

On the assets side, the accelerated growth of total deposits in June primarily resulted in larger bank deposits with the CNB, while loans to domestic sectors continued their upward trend in June on a monthly level (by EUR 0.2bn or 0.6%, transaction-based), entirely in the household lending segment. Housing loans increased by only EUR 0.1bn despite a new round of the housing loans subsidy programme, while general-purpose cash loans increased half as much. The smaller volume of granted housing loans relative to the levels recorded in June last year is probably due to the ongoing strike of civil servants in the judiciary. In the structure of corporate loans, the decline in investment loans, overdrafts on transaction accounts and syndicated loans was offset by the rise in loans for working capital, so that total corporate loans and loans to other financial institutions remained almost unchanged. On an annual level, loans to households edged up (from 6.5% in May to 6.6% in June, transaction-based) due to the acceleration in the growth of general-purpose cash loans (from 5.7% to 6.3%), while the annual growth of housing loans slowed down (from 9.5% to 9.2%). Loans to non-financial corporations went down over the same period, from 13.9% to 13.5%, with a decelerated fall in loans to other non-banking financial institutions (from −3.6% to −1.0%). As a result, the annual growth of total loans to domestic sectors edged down, from 9.3% in May to 9.2% in June (Figure 2).

For detailed information on monetary statistics as at June 2023, see:

Central bank (CNB)

Other monetary financial institutions

-

Domestic sectors in the Comments exclude the general government. ↑